Good for you but perhaps a little insensitive to the folks that are worried at this time as to where they stand now with MCE?

I feel for you.

I don’t know if this will help but when the same thing happened to me a few years ago I persuaded MasterCard to reclaim all of my premium from the insurance company on the basis they did not deliver the goods i.e. they didn’t provide insurance for the full year. I then wrote to the insurance company and said I would pay them for the period they did insure me which I think was 10 months. They responded by saying I should repay the 12 months premium and they would consider a refund for the period I wasn’t covered. I declined and heard nothing more.

Good luck in finding a new insurer.

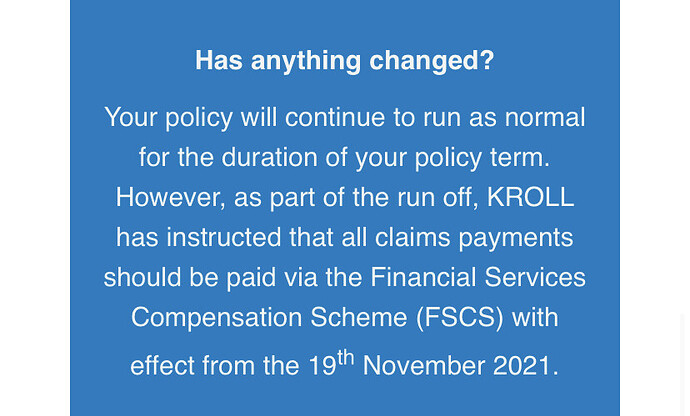

The Financial Services Compensation Scheme is a company funded by the financial industry to provide protection to consumers, and it sounds like we should be okay.

Sarah Marin, Chief Customer Officer at FSCS, said:

“FSCS will protect the majority of UK-based customers of MCE Insurance Company Limited who are individuals or small businesses with an annual turnover of less than £1m. We want to reassure MCE Insurance Company Limited customers that their claims will continue to be considered against the terms of their policy and that FSCS will be stepping in to protect eligible customers.”

I think when it says “the majority” will be protected it is only because part of the definition of being eligible is that the insured vehicle also needs to be U.K. registered, which might not be the case for some customers.

If they do eventually just cancel the policy without a refund, and you paid for it by a credit card, then you have the legal protection to get your money back as eezie describes.

But you will not be able to do that at the moment as you are still receiving the insurance service you paid for.

If you want to move elsewhere now, presumably the only option is to cancel the policy as normal, with the associated fee for that taken out of the refund.

So at the moment it is probably best to just see what happens, as you are still legally insured and there is protection to cover any claims.

The below page from the F.S.C.S. is probably the best place to follow for updates:

You can also get updates from the administrators on their page:

https://www.kroll.com/en/mce-insurance-company-limited

Nothing of note here, but for completeness this is the regulator’s statement:

And moving is more expensive than insurance!

Fair point well made, apologises for any insensitivity and/or hijacking the thread I thought the discussion on MCE had drawn to a conclusion and was replying to @Gabriall about being punished for living in London. We had similar feelings before we moved outside the M25 when working and then out further still when we retired. Its true when moving out of London there’s no going back but there’s no looking back either. Just an option to consider if you’d like a decent garden, your own drive and garage all at half the cost of London property prices.

No sweat Art you help us all out with tons of good advice. You’ve forgotten more about bikes than I’ll ever know.

Thanks for the advice, I’ll wait it out a bit longer/keep running new quotes to see if I can match/beat it then probably cancel and swap

So if you have a MCE policy underwritten by MCE Gibraltar ( I think that’s all of them ) then you will need to claim via the FSCS. The FSCS will pay 100% of your third party claim but only 90% of first party claims… What we cover | Check your money is protected | FSCS

You still claim through MCE (the broker), as noted on the administrator’s web site

Claims arising from insurance policies issued by the Company continue to be handled by MCE UK.

MCE UK will continue to be the primary contact for insurance policy holders on behalf of the Company in Administration.

MCE UK and the Joint Administrators will liaise with the Financial Services Compensation Scheme in relation to eligible insurance claims and, in due course, other statutory compensation schemes of other countries as appropriate.

Please note that there may be a slight delay in receiving a response to your correspondence.

Good point on the amount of protection provided if the administrator is unable to cover the other 10% of first party claims.

I wonder if that would be means to end a policy without penalty, as presumably MCE would no longer providing the service paid for.

Thanks so much for taking the time to look into this and sharing such clear summaries @Michael. Very much appreciated.

If I see you at a meet someday I’d like to buy you a drink/coffee/tea/whatever (or fish and chips when there’s another Brighton run  ).

).

My MCE policy started only 2-3 month ago  .

.

As you mentioned earlier in the thread, there wasn’t another insurer that I could afford to go with for my bike and location  .

.

Thanks kylejm.

Here is the latest update from the company, basically if you want to make a change to policy you have to cancel and start a new one (with MCE or anyone else), but you will lose 10% of the outstanding premium.

We have since been instructed by the administrators that no midterm adjustments can be processed on any Green Realisations 123 Limited policy with immediate effect.

What is the cancellation process?

You can cancel your policy by contacting us on: 01933 351361 and a handler with process this for you.

A return of premium will be calculated in line with the policy terms and conditions, subject to all premium payments being brought up to date. For eligible policyholders, the FSCS will pay 90% of any return of premium that is due.

Green Realisations 123 is the new name for MCE Insurance Company (the broker). It is normal to rename insolvent companies to change names.

But I missed the background to what is happening. It seems the company was being wound-up with policies to be transferred to a new broker when the regulator applied to put the company in administration.

MCE described the situation as “the latest in what appears to be a vendetta against MCE UK-Co and an act to sabotage a successful portfolio transfer.”

The GFSC has applied Capital Add Ons to Green Realisations No. 123 Ltd. (GR, formally MCE Insurance Company Ltd.), which has in turn led to an orderly and solvent filing for administration, MCE UK business had already made the decision to restructure and transfer our portfolio to a UK insurer, the GFSC had been made aware of this.

MCE’s recovery program would have injected £20.5 million into GR. The GFSC have declined these recovery measures, for reasons we cannot understand.

Insurance companies have a solvency capital requirement, which is an amount they must hold to be able to cover their worst expected scenario of claims. A capital add-on is an additional amount above this a regulator can require if necessary. Obviously if a company does not meet this overall requirement it is no longer solvent.

The regulator has denied the claims.

The GFSC strongly denies the recent accusations made against it following an application to the Supreme Court of Gibraltar for an Administration Order made by MCE Insurance Company Limited (“the Company”) itself on the 19 November 2021. The GFSC consented to the application made by the Company.

It should be noted that for an Administration Order to be granted (under the Gibraltar Insolvency Act 2011), the Court must be satisfied that the company is insolvent or likely to become insolvent.

And us policy holders are stuck in the middle of it all!

My quick read of that latest email received had me with the impression that cancelling was the option if you wanted to make changes, however I must have misread it as I was understood there to be no refunds.

My only anticipated change is to request a green card at some point for foreign travels. This I hope doesn’t require a change of policy.

I’m in my second year with MCE, lower premiums being the reason. Their service is appalling given the amount I paid. Perhaps their attitude to customer service/ interest in the business of motorcycling is amongst the reasons for their demise. I might miss the premiums but I won’t miss the service.

There is no demise, MCE Insurance (the British-based insurance broker) is unaffected by all of this.

But they owned their own underwriter (the Gibraltar-based company now renamed Green Realisations 123), and that is all that has been affected. They were going to close it down, I guess by either selling the policies or company, but the court put it into administration at the request of the regulator.

For all new business, MCE policies are now underwritten by Sabre Insurance Group, who previously mainly dealt with car and van policies.

So the quality of service will remain the same because all administration is still handled by the same MCE company and people in Northants. The only question is whether the prices offered by Sabre will be similar to those from Green Realisations 123.

But it does leave people with existing policies, or who have outstanding claims from previous ones, having to deal with the mess because the administrator will not pay out on ay claims or accept changes to policies. Instead they are leaving it to the Financial Services Compensation Scheme, which will only pay out 90% of anything owed from a claim or cancellation.

So basically to a policy holder everything carries on as normal, including renewals with them if you want, except that to make a changes mean cancelling and taking out a new policy, and whatever happens with a current policy you will be 10% worse off.

And now you can make policy changes again!

We contacted you on Friday 3rd December to advise that we had been notified by the administrators of Green Realisations 123 Limited (Formerly MCE Insurance Company Limited) that we would no longer be able to process any midterm adjustments on live policies.

Following this email communication we have been contacted by the administrators to advise this decision has been reversed and midterm adjustments can be processed.

Based on this we can continue to process midterm adjustments on your policy should you need to.

Your policy will remain on cover and continue to run up until your lapse date. You will still be able to make a change, access your documents or make a claim on your policy until then.

Please accept our apologies for any inconvenience this may have caused.

Looks it’s time to shop for a new policy:

Your Policy is Ending on

31/01/2022

Dear Slacker

Green Realisations 123 Limited (formerly MCE Insurance Company Limited) (In Administration) (“the Company”)

This communication is provided to you by the Joint Administrators of the Company and contains important information which affects your insurance policy.

Andrew Stoneman and Geoffrey Bouchier of Kroll were appointed Joint Administrators of the Company on 19 November 2021 by Order of the Supreme Court of Gibraltar. Both are licensed to act as Insolvency Practitioners. Andrew Stoneman is licensed in Gibraltar while Geoffrey Bouchier is licensed in England and Wales.

Please read this communication in full as it requires you to take action.

Intention to Disclaim your Insurance Policy

Your policy of insurance is underwritten (or is provided to you) by the Company, which is in Administration. The Company’s permission to write insurance was suspended on 5 November 2021.

Due to the financial position of the Company, the Joint Administrators intention is to disclaim all motor bike and scooter insurance policies as at 24:00hrs (being midnight) on Monday, 31 January 2022.

This means that when your policy of insurance is disclaimed, your insurance policy will cease or, in other words, end.

This means that you will need to seek and put in place alternative insurances prior to your policy being disclaimed on 31 January 2022.

Up until your policy is disclaimed, and on the basis that you are fully complying with the terms and conditions of your policy of insurance, your policy will remain valid. No adjustments will be permitted to your policy from today except for administrative adjustments which do not affect the risk associated with the policy of insurance – such as correction to the spelling of a name for example.

Am I eligible for a refund?

If you paid for your insurance policy in one lump sum at the commencement of your policy of insurance or your paid monthly amount includes insurance cover for the period after 31 January 2022, you are likely to be eligible for a refund for the unused portion of your insurance policy by the Financial Services Compensation Scheme (“FSCS”), subject to eligibility and their compensation rules. The FSCS may write to you separately. You can find information on the FSCS on their website at https://www.fscs.org.uk/what-we-cover/insurance/ and https://www.fscs.org.uk/making-a-claim/failed-firms/mce-insurance/

Claims

Claims arising from insurance policies issued by the Company prior to and up to the date policies are disclaimed will continue to be handled by MCE Insurance Limited (“MCE UK”). MCE UK handled claims for the Company prior to the Joint Administrators’ appointment as well as providing other services.

Their contact details are shown below:

via Live Chat on the website (www.mceinsurance.com)

email: [email protected]

Customer Experience Team: +44 193 335 1361.MCE UK is not in Administration and is a separate business to that of the Company.

MCE UK and the Joint Administrators will liaise with the Financial Services Compensation Scheme in relation to eligible insurance claims.

Arranging new insurance

Please contact your broker MCE UK to arrange alternative cover or if you are not sure, it’s very important that you talk to an expert about replacement cover for the future, please contact an insurance broker who specialises in motor insurance policies. If needed you can use the British Insurance Brokers’ Association’s “Find Insurance”-service. You can find this at https://insurance.biba.org.uk/find-insurance or you can phone them on 0370 950 1790.

Additional Assistance

If you believe your circumstances warrant additional consideration, or have specific needs in the way we communicate with you, please let us know – contact details above.

What happens Next?

The Joint Administrators will contact you again to remind you of the intention to disclaim on 31 January 2022.

The Joint Administrators will also provide you with a copy of the notice of disclaimer in due course for your records.

Yours faithfully

For and on behalf of

Green Realisations 123 Limited (formerly MCE Insurance Company Limited)

I got the same email too. Bet it takes months before i get my money back

I feel you. I paid the whole amount in advance and still have over half year of cover left.

What the fuck!

I thought they said we got to keep our policies!

Hope this doesn’t mess with our no claims discounts.

Seems unclear to me whether a cheque will arrive in the post as there seems to be eligibility questions. Always a caveat where refunds are mentioned.

So if you were an insurer and have many many people after quotes to start 1 Feb what would you do? Do you even think it will be possible for a conversation to be had with another insurer…they’ll be very busy!

And another thing…I want 2 years NCB for my next policy, not 1 year and 8 months!

Insurance is the biggest scam of them all.